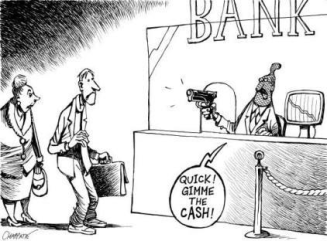

WILL THE BANKS FREELY REFUND THE FLOOR CLAUSES WRONGLY CHARGED?

The government approved on 20 January 2017 the Royal Decree-Law 1/2017 in relation to the proceeding to refund the floor clauses. In relation to this Royal Decree-Law it might be necessary to recall that neither the Supreme Court judgment of 2013 nor the European Court judgment of December 2016 nullified all the floor clauses (as explained in previous posts). The Supreme Court ruled that the floor clauses could be considered valid when fulfill all the “special transparency requirements of the contracts signed with customers and consumers”. What does the judges mean by “special transparency requirements”?. Basically that the customers should have been clearly and precisely informed about the consequences of the floor clauses, specially facing the complexity of those clauses.

ONE MAN´S MEAT IS ANOTHER MAN´S POISON

You can please everybody. The Royal Decree Law does not satisfy everybody and, probably, although the resolution has approved an extra-judicial proceeding to avoid lawsuits against the bank, the majority of the cases will end up in Court.

What is the extrajudicial proceeding?: All consumers affected by “floor clause” can claim (free) before their banks the liquidation and devolution of sums wrongly charged out of “clausula suelo” (floor clause). I would like to point out that the RDL 1/2017 states that “consumer” are those “natural persons” mentioned in article 3 of Protection Consumer Law (Legislative Royal Decree 1/2007), without mentioning the “legal persons” (entities/companies). And article 3 of Protection Consumer Law includes the “legal persons”. We have to wait and see what will be the bank position in relation to these legal persons. The bank has the obligation to reply in favour or against the petition (if the answer is negative, explaining the reasons) and calculate the liquidation.

Time limit: the bank will have one month to set up the actions to start with the proceeding. Despite of this, the consumer, does not have to wait one month and enact the extra-judicial proceeding. The bank will be enforced to reply within 3 months. There would be 3 scenarios:

- The bank accepts the petition but the client is not happy with the liquidation sum: end of the extrajudicial proceeding and the customer is free go to Court.

- The bank accepts the petition and the client is happy with the liquidation: en

- The bank rejects the petition or do not reply in 3 months: end of the extrajudicial proceeding and the customer can go to Court (although he can go to Court directly without being necessary to enact the voluntary extrajudicial proceeding). End of the extrajudicial proceeding (no Court case).

In any case, if the client does not accept the bank´s offer he will be free to go to Court. He can also go to Court directly but, depending on the bank attitude facing the lawsuit, the bank would be or would be not condemned to pay the legal costs.

Clients who found a position prior to the European Court judgment: we must bear in mind that after the Supreme Court judgment of May 2013 many clients found a position with the bank in relation to the floor clauses. If these customers think that the agreement does not match with the European Court judgment of December 2016 can also come up to the extrajudicial proceeding approved by the RDL 1/2017. Note that EVERY CASE will be INDIVIDUALLY studied.

Bank threats: there are many bank branches that are threatening their own clients warning them in case they go to Court (forcing them to sign a document with dubious clauses). This type of conduct is not the spirit of the RDL which pretends to avoid a huge amount of legal claims but not take advantages of people (specially aged people) that does not want to go to Court.